Each such byte focuses on a functional issue startups need to solve as they build their company, from idea to scale. In this edition, we speak about working capital.

How does your heart remain functional? It is the constant blood that is pumped in and out of it that keeps it hale and hearty. In business parlance, that constant beating heart is the working capital. How can we understand and customize our growth and financing needs based on our working capital structure?

Working Capital refers to the funds that are required for the day to day operations of the business. It can also be explained as the excess of current assets (like inventory, receivables) over the current liabilities (like Payables and accrued expenses). These are essentially items that are to be paid or received within a year. Therefore, the formula for working capital is as below:

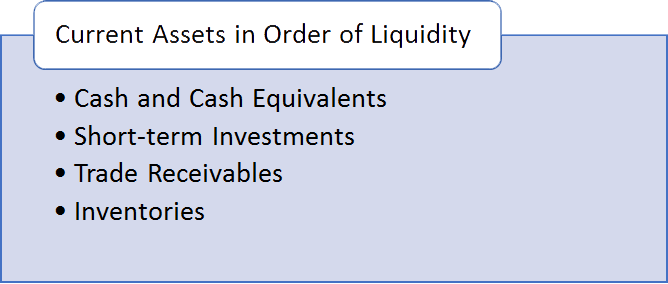

This result can be positive or negative. A positive working capital may indicate that the business has enough liquid funds to meet its short-term obligations while also having some reserves in store to finance its growth without depending on external financing. However, it is also important to be aware of the composition of current assets (see figure 1) while having a positive working capital. Having too much working capital fixed in inventories or receivables that have not been collected for long, can be a sign of inefficiency. The company might be using long-term resources to fund these short-term ‘assets’ which is a glaring mis-match as it makes the former unavailable for purposes like expansion or capital expenditure. As a business owner, periodically analyzing how much portion of the current assets is constituted by sticky inventory or receivables and the turnover periods associated with them, is essential to maintain the optimum level of working capital. Using Just-in-time procedures and investing in a competent collections team can also help in this regard.

A negative working capital may indicate that the business in not capable of meeting its short-term obligations with its current assets. This can be a cause of concern signifying that the company is struggling to make ends meet. The company will therefore require additional financing to bridge the gap. Looking at this from another angle, a negative working capital simply means that your current liabilities are greater than your current assets and this need not necessarily be alarming. For this, it is important to understand the reason for low level of current assets. If your business gives low or no credit period to the customers while still receiving credit from your suppliers, you are able to generate cash quickly that enables you to sell your product to the customer long before you are due to pay your creditors. Consequently, the level of current assets will be lower than the current liabilities, in this case, meaning that you are able to monetize your current assets much before you need to meet your liabilities. By design, certain sectors tend to have negative working capital like – Entertainment industry, grocery stores and restaurants (essentially because they are cash-only businesses).

Another ratio that we typically tend to look at is the quick ratio, which considers only the quick assets (Current Assets less Inventory and Prepaid Expenses) in the numerator to provide a more conservative result while taking into account the fact that liquidating the inventory may not be always very simple or aligned with market conditions. In this case, again, convention petitions us to target a ratio of 1x, but as stated for the current ratio, conventions come with caveats customized for your business! It may be noted that a vast difference between the current and the quick ratio calls for you to assess the business’ operating cycle.

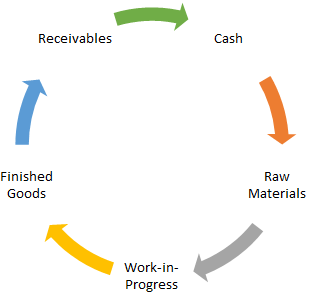

Operating Cycle refers to the time taken by the business to complete the working capital cycle i.e. the number of days to complete the cash-to-cash cycle. This is illustrated in the diagram given below:

The various aspects of this cycle determine the efficiency of the business. In this context, it is important that we understand the following concepts:

Inventory Days: Average no. of days that the company holds the inventory before making a sale.

Receivable Days: The credit period (in days) given to the customers to make payment for the goods purchased.

Payable Days: The credit period (in days) extended by the suppliers to the company to make payment for the raw materials procured.

Therefore, Operating Cycle is nothing but

Having a positive/higher operating cycle means that the company will be out of cash for certain days before it receives payment for the goods sold. This will require the company to look for external assistance to finance the payment to be made to the supplier as payment to him/her will need to be made before the company receives the payment from its customers. Additionally, a longer operating cycle will require you to make higher profits on your sales to compensate for the opportunity cost of the resources blocked in inventories and receivables.

TIP: When looking for external financing in such cases, it may also make sense to observe the cash flow patterns of your business. If there is a predictable and stable cash flow through the year, or you are funding the minimum threshold of working capital required to keep your business running, a term loan structure may work out best for you. Term loans are not only intuitively simple, but also come with lower lifetime costs. On the other hand, if your business is characterised by inconsistent and variable cash flows (or is seasonal in nature), a revolving credit facility may be the most useful option. The flexibility offered through such a facility can support your business as and when your cash flows bottom out, with peak flows being used to repay on the loan. You not only get financing exactly when you need it, but also are able to manage the intermediate costs of financing.

Having a negative operating cycle means that the company can generate cash quickly and can receive payment from the customer before it must make payments to its supplier. In other words, it can use the supplier’s money to grow. While a new business may find it difficult to achieve a negative operating cycle, over time, revamping your business model to changes in the business landscape to adopt to new and better ways of conducting operations apart from building trust and healthy relationships with both suppliers and clients can help you achieve this goal. Negotiation gets better as vintage of the business improves.

Duration of the operating cycle can be considered a useful indicator of the liquidity and asset-utilization capability of a firm. While the conventional current and quick ratios can prove to be misleading if used in isolation, the operating cycle can be a useful accompaniment to reach meaningful conclusions.

Managing your working capital is one of the key areas for the success of your business. Therefore, understanding and forecasting your future working capital requirements is vital to ensure that the heart of the business runs efficiently.

This article has focused on the application of the operating cycle in understanding the working capital and liquidity position for businesses broadly in the merchandising or manufacturing segment. In the next article, we intend to provide a guide to analyse the same for financial institutions and the service sector. Will current ratio and operating cycle still be applicable in these cases?

Let us know if you have questions or feedback. Reach out to us on info@caspian.in.